HS-Code

info

Having correct harmonized schedule code classification is important to calculate duties and taxes. DHL can support you with code classification.

What is an HS code?

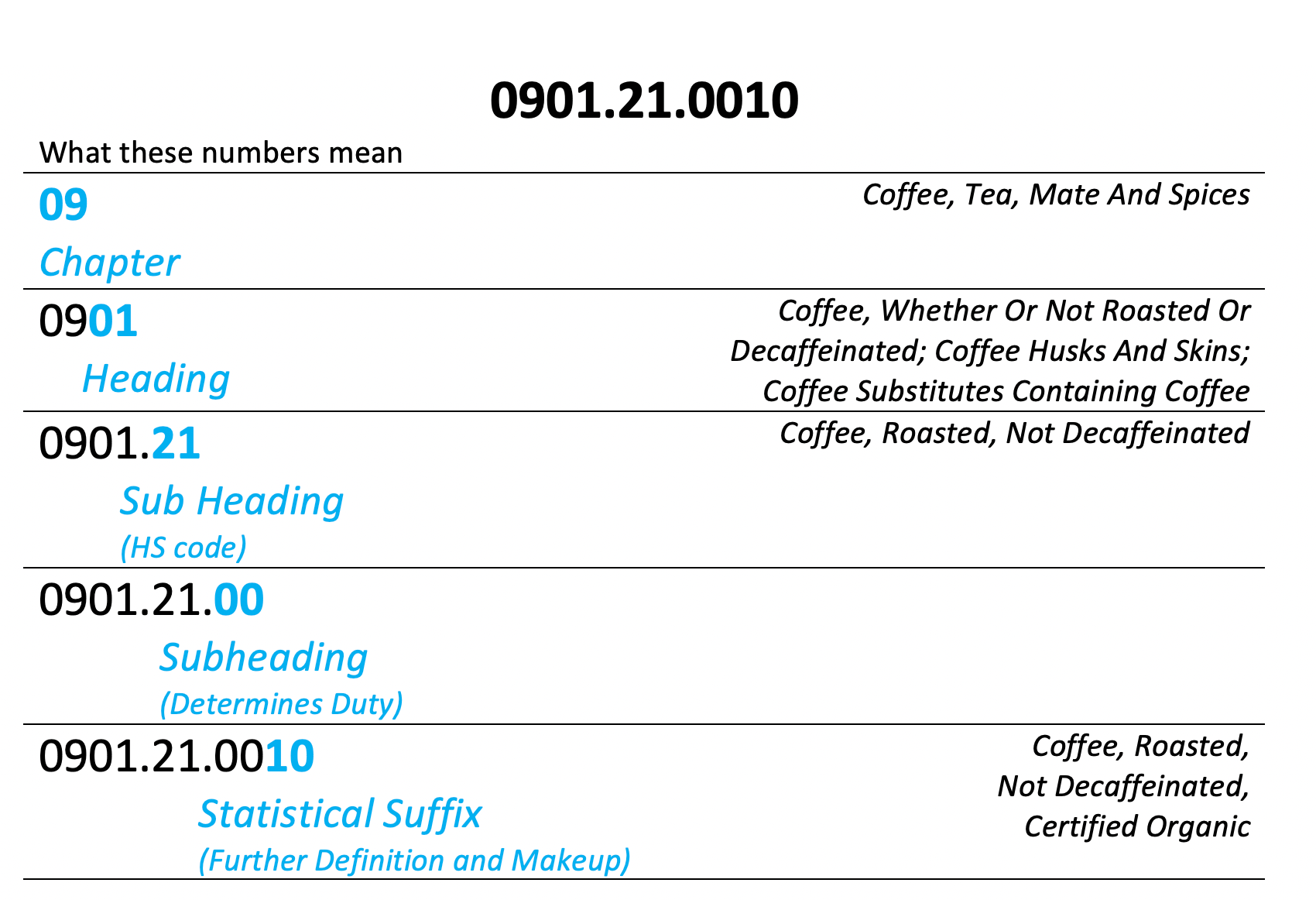

- An internationally accepted system of names and numbers used to classify traded products

- Maintained by the World Trade Organization, these codes are standardized across all countries in the WTO at 6 digits. Past digits, it becomes country-specific

- Find the average duty rates by HS code and country here: http://tariffdata.wto.org/ReportersAndProducts.aspx

Why do I need HS codes?

- Determines the tariff and duty rates of the traded products

- Identifies products that are imported or exported through a country’s borders

- Classifies & categorizes products in a worldwide system used for customs clearance purposes

What if I don't have my HS codes?

- Many merchants don’t realize they do have them – on the import documents!

- Your manufacturer or carriers may have them

- You can search online for informational purposes using UK Govt website for an idea of possible ones: https://www.trade-tariff.service.gov.uk/sections

HS code strategy

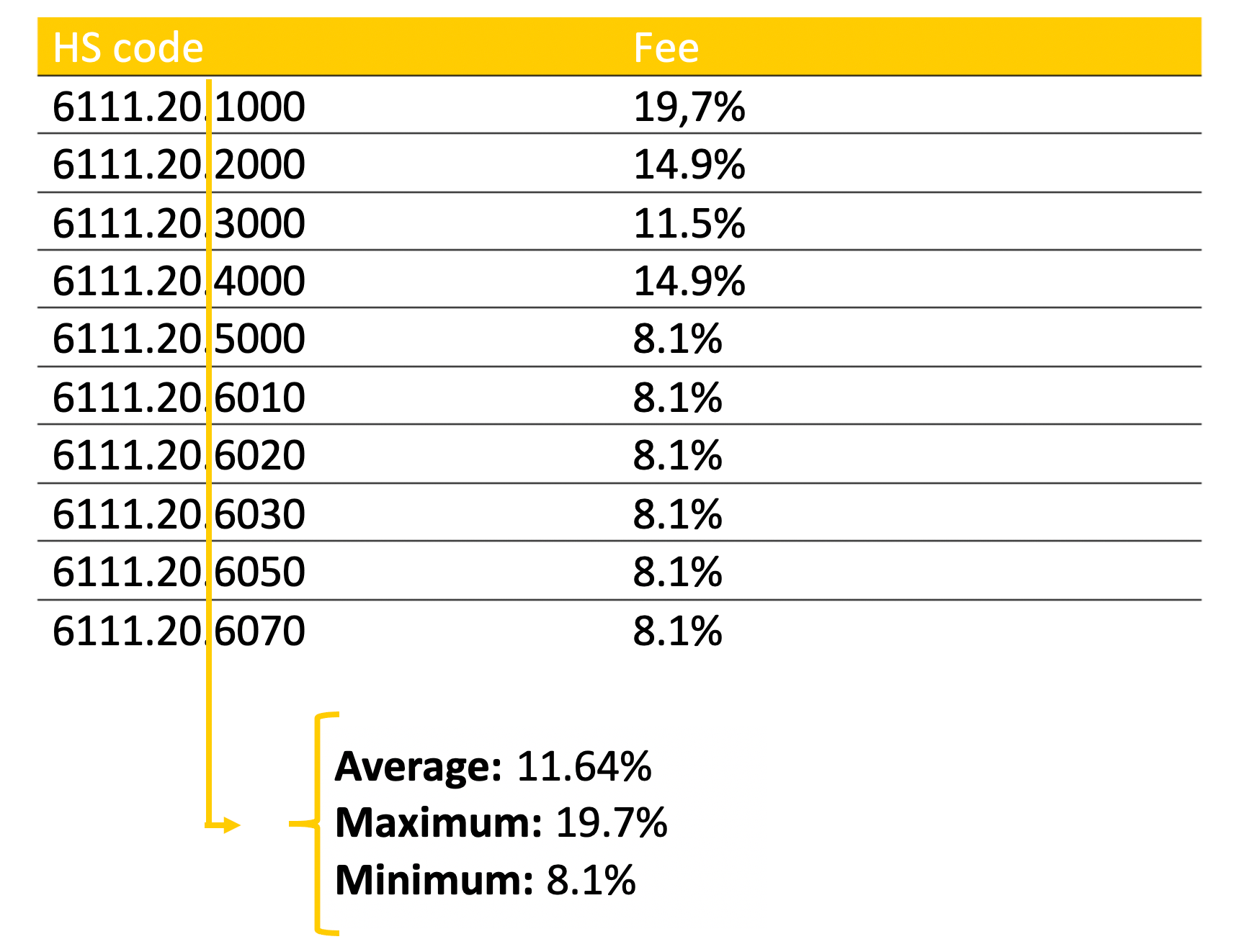

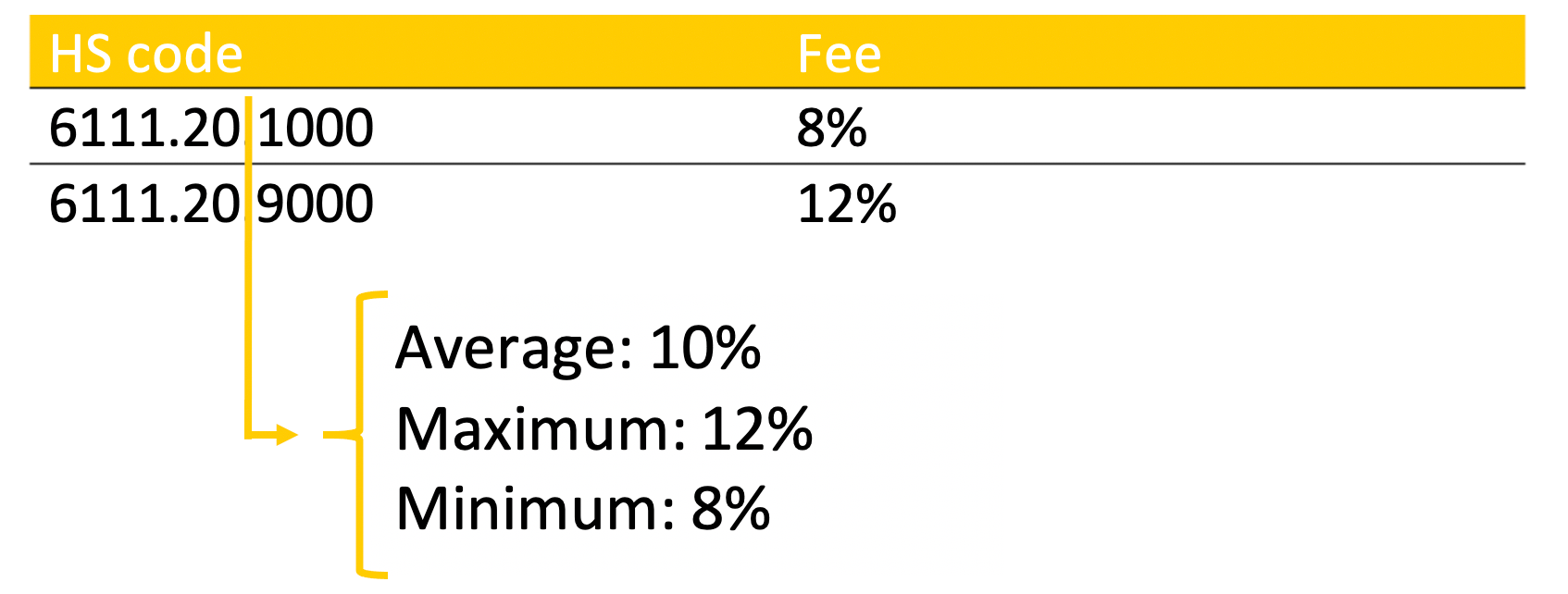

When you choose the Pricing Strategy to apply, consider the fee calculation that takes into account the 6-digit level to return the value based on the configuration: average, maximum, or minimum.

- MINIMUM - The system will return the minimum duty rate found in the tariffs based on the number of HS digits the caller provides in the request.

- MAXIMUM - The system will return the maximum duty rate found in the tariffs based on the number of HS digits the callers provide in the request.

- AVERAGE - The system will return the average duty rate found in the tariffs based on the number of HS digits the caller provides in the request.

The following examples show the logic applied to the same product, shipping for different destinations.

Example 1: Shipping to the USA

Example 2: Shipping to UK

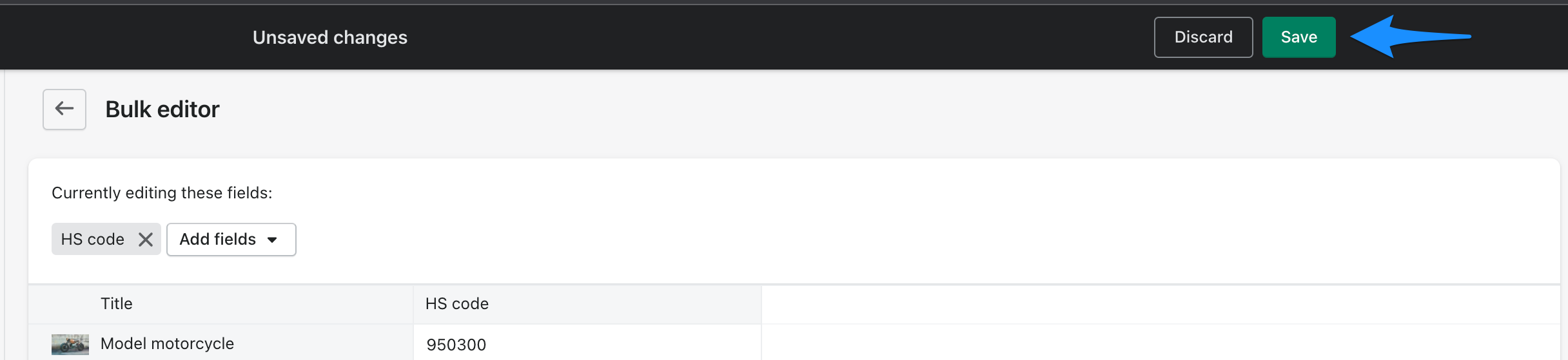

Add HS code with bulk editor

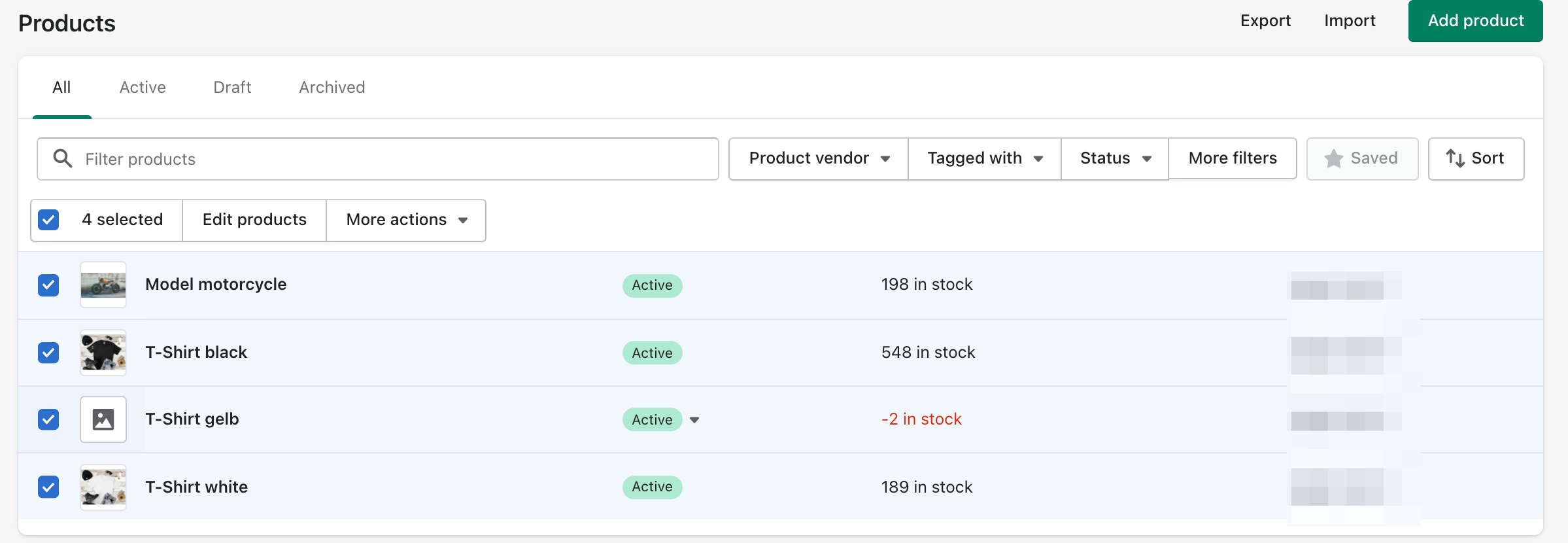

- Please open your Products in Shopify.

- First of all, please select the products you want to edit.

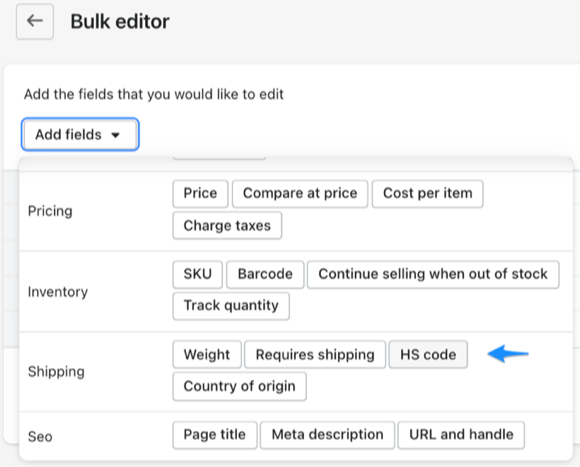

- After that, please select these fields, which you want to edit for several of your products.

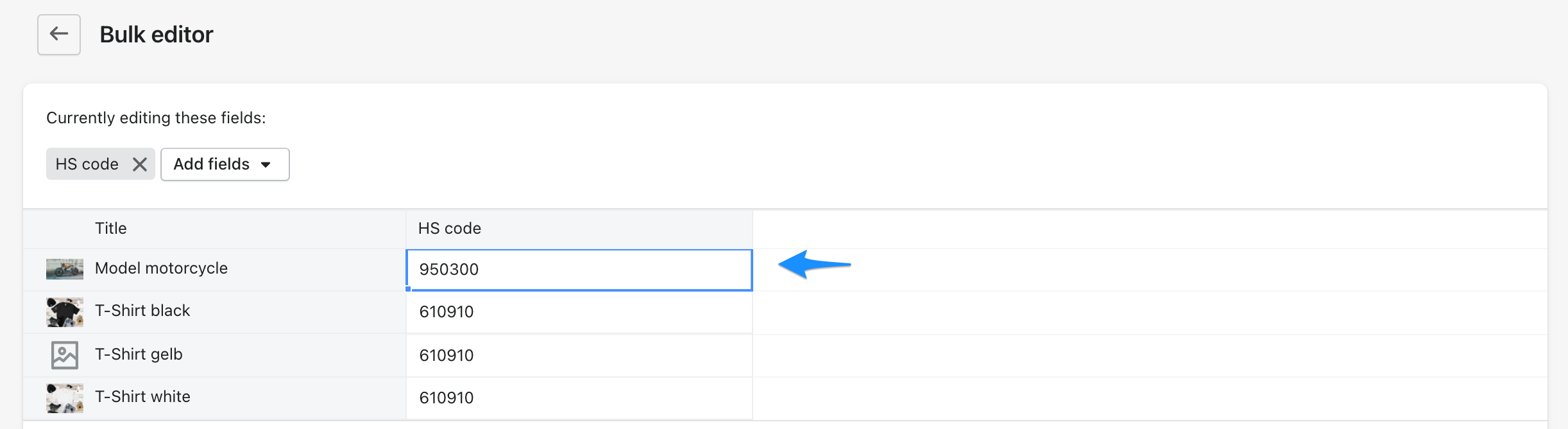

- Afterwards you can edit the HS codes of your products collectively.

- Do not forget to save your changes.